Protect yourself from the nation’s emerging retirement crisis.

How To Stop The Federal IRMAA Law From Crushing Your Social Security Benefits

WATCH THE TRAILER

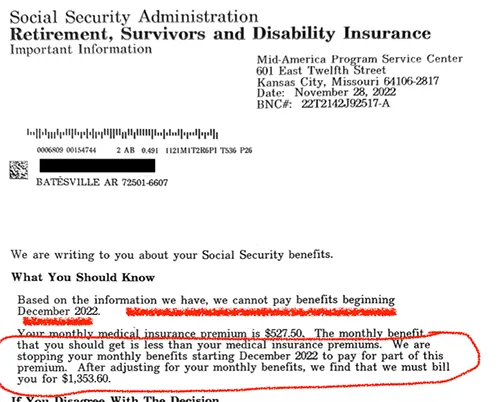

Do You Want to Avoid Getting A Letter Like This?

THE INCOME RELATED MONTHLY ADJUSTMENT AMOUNTS (IRMAA) LETS THE GOVERNMENT USE YOUR RETIREMENT SAVINGS AGAINST YOU TO:

Raise Your Taxes

Increase Medicare Costs

Reduce or eliminate your social security benefits.

PUT THE CONTROLS BACK IN YOUR HANDS

Learn how to protect your retirement savings, and get all your questions answered by the foremost IRMAA experts in the country in this groundbreaking mini documentary: Social Insecurity

IN THIS MINI DOCUMENTARY YOU’LL DISCOVER:

Why you may get a letter from the social security administration that tells you your social security benefit has been eliminated.

How you could end up paying the government instead of getting a check from Social Security! Like this:

The 3 different ways your 401(k) could be taxed.

How IRMAA is a blatant redistribution of wealth.

Why your spouse could be taxed on income she never receives.

Why it doesn’t matter what the stock market or real estate does–all that matters is what the government is planning to do to your retirement income.

How the government plans to take from those who have paid the most in taxes to shore up social security with your retirement savings.

Register now for this online educational event to learn what you need to know (in less than 30 minutes!) about protecting your Social Security check.

Once you’re registered you’ll receive an email with a link to the mini documentary.

WATCH THIS FREE DOCUMENTARY TO LEARN HOW TO PROTECT YOUR SOCIAL SECURITY AND RETIREMENT FROM THIS MAJOR EXPENSE IN RETIREMENT

Many affluent investors are on a path of destruction with their traditional retirement plans, and they don’t even know it! The more you save, the bigger the problem… you need to take action NOW!

WHAT TO EXPECT:

Learn what IRMAA is, how it works, & how to avoid it.

Get a personalized Report On How IRMAA will affect your retirement.

How to maximize your retirement income.

Why maximizing your social security could end up being a costly mistake.

By signing up via text, you agree to receive recurring automated promotional and personalized marketing text messages from Wealth Education Group at the cell number used when signing up. Consent is not a condition of any purchase. Replay HELP for help and STOP to cancel. Msg frequency varies. Msg & data rates may apply. View Terms & Privacy.

IRMAA FAQS

Answers to the most common questions about this program.

I’m so young–why should I worry about Medicare and Social Security now?

Medicare & Social Security are severely underfunded, and there’s a wave of baby boomers retiring en masse over the next 15 years. These rising medical costs have to be absorbed and will put many people, young & old, in the crosshairs of IRMAA thresholds. Too many investors have been advised to “max-out” their tax-deferred retirement plans, this has lots of potential negative tax & IRMAA consequences, even sabotaging many retirement plans with lots of unexpected costs! The time to be planning and saving correctly is now so you can avoid many of these unforeseen events, and certainly keep more of your hard earned money.

What are the chances that IRMAA threshold get lowered?

In the last month, Senators like Elizabeth Warren have voiced their desire to lower IRMAA guidelines, or as Bernie Sanders suggested “Medicare for all!” The Bipartisan Budget Policy Act of 2015 discussed IRMAA and proposed lowering the income thresholds, and was only tabled because President Trump tabled IRMAA for 5 years with his tax concessions. However, he specifically left the discretion up to the President to change it at any time. It’s often been suggested that if the government can tax it, they probably will, but it’s often at the expense of those with higher incomes. Why would people risk it when proper planning can help avoid this?

How is IRMAA calculated and how is it paid for?

All income, from 401(k)’s, IRA’s, pensions, brokerage accounts, real estate, etc counts towards IRMAA, and it’s paid for out of your social security benefits. If your social security is all used, then you will actually have to pay out of pocket for your Medicare premiums. We have a custom report that we share with people on their situation, and it’s not uncommon to see many more affluent investors (doctors especially come to mind) losing millions to lost social security benefits and taxes.

IRMAA Documentary © 2023 All Rights Reserved | Privacy Policy | Terms Of Service